knoxville tn sales tax rate 2019

Income and Salaries for Knoxville - The average income of a Knoxville resident is 23177 a year. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

Histogram Of Sales Tax Revenue Total State Revenue For The 50 Download Scientific Diagram

- The Median household income of a Knoxville resident is 33494 a year.

. The Knoxville sales tax rate is 0. Submit a report online here or call the toll. 2019 Tennessee Property Tax Rates.

County of Knoxville where a parcel is unfit for occupation or use and thus the sale of these parcels may also be subject to any and all such costs and expenses incurred by the City and County of Knoxville to the extent applicable. The minimum combined 2022 sales tax rate for Knox County Tennessee is. The Tennessee state sales tax rate is currently.

ANDERSON Charleston Tiptonville South Pittsburg Selmer South Fulton Lenoir City SEQUATCHIE Covington Johnson City. La Vergne TN Sales Tax Rate. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

8 rows Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum. This is the total of state county and city sales tax rates. 05 lower than the maximum sales tax in TN.

The 2018 United States Supreme Court decision in South Dakota v. The general state tax rate is 7. The 925 sales tax rate in knoxville consists of 7 tennessee state sales tax and 225 knox county sales tax.

The sales tax is comprised of two parts a state portion and a local portion. Did South Dakota v. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

This page provides general information about property taxes in Knox County. For questions regarding the below rates or about the certified tax rate process please contact the offices of the State Board of Equalization. 24638 per 100 assessed value County Property Tax Rate.

179 004 1658th of 3143 072 001 1728th of 3143 Note. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Ad Find Out Sales Tax Rates For Free.

Real property tax on median home. CountiesJurisdictions 2015 CTR 2016 CTR 2017 CTR 2018 CTR 2019 CTR 2020 CTR. Please click on the links to the left for more information about tax rates registration and filing.

The local tax rate varies by county andor city. On the day of the sale the Clerk and Master of Chancery Court will conduct an auction on behalf of the City of Knoxville selling each property individually. Kingsport TN Sales Tax Rate.

Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. This amount is never to exceed 3600. For tax rates in other cities see Tennessee sales taxes by city and county.

Memphis TN Sales Tax Rate. The Tennessee sales tax rate is currently 7. Maryville TN Sales Tax Rate.

This is the total of state and county sales tax rates. The Knox County sales tax rate is. - Tax Rates can have a big impact when Comparing Cost of Living.

Track your money in Mint. Local collection fee is 1. - The Income Tax Rate for Knoxville is 00.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is 925. State Sales Tax is 7 of purchase price less total value of trade in. Local Sales Tax is 225 of the first 1600.

31 rows Johnson City TN Sales Tax Rate. The high bid today may be raised by ten percent 10 within the next ten 10 days or by Friday September 27 2019. Morristown TN Sales Tax Rate.

If you need specific tax information or property records about a property in Knox County contact the Knox County Tax Assessors Office. Current Sales Tax Rate. Fast Easy Tax Solutions.

What is the sales tax rate in Knox County. The US average is 28555 a year. The average salary of Retail Sales Associates in Knoxville TN is 23500year based on 64 tax returns from TurboTax customers who reported their occupation as retail sales associates in Knoxville TN.

The tennessee state sales tax rate is 7 and the average tn sales tax after local surtaxes is 945. County City SpecialSchoolDistrict CountyRate CityRate SpecialSchoolDistrictRate Total Jurisdiction TaxYear. 212 per 100 assessed value.

Our premium cost of living calculator includes state and local income taxes state and local sales taxes real estate transfer fees federal state and local consumer taxes gasoline liquor beer cigarettes corporate taxes plus auto sales property and registration taxes and an online. 24638 per 100 assessed value county property tax rate. The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated.

Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. There is no applicable city tax or special tax. The County sales tax rate is 225.

Purchases in excess of 1600 an additional state tax of 275 is added up to a. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. Murfreesboro TN Sales Tax Rate.

State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. Lebanon TN Sales Tax Rate. 925 7 state 225 local City Property Tax Rate.

Knoxville TN Sales Tax Rate. Effective Tax Rates for Retail Sales Associates in Knoxville TN. Knoxville Tn Sales Tax Rate 2019.

64 full-time salaries from 2019. You can print a 925 sales tax table here. The US average is 46.

Sales Tax State Local Sales Tax on Food.

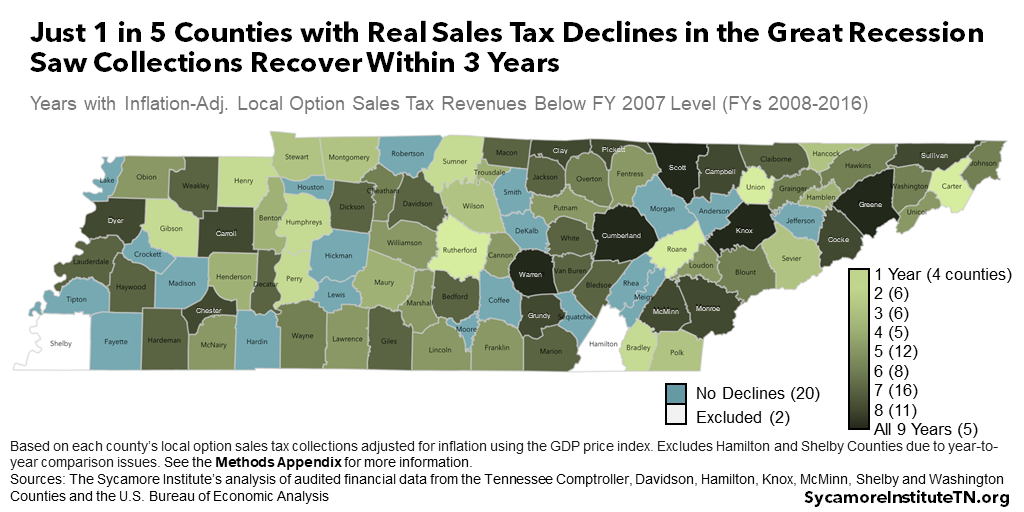

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

1559 Laurens Glen Ln Knoxville Tn 37923 Mls 1086055 Zillow Dream House Plans House Styles Home Inspector

Tennessee Car Sales Tax Everything You Need To Know

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Car Sales Tax Everything You Need To Know

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Traditional Finances City Of Conroe

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Taxes Do Residents Pay Income Tax H R Block

Traditional Finances City Of Conroe

Tennessee Sales Tax Rates By City County 2022

Sales Tax On Grocery Items Taxjar

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue